Code

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

%matplotlib inline

import seaborn as sns

import itertools

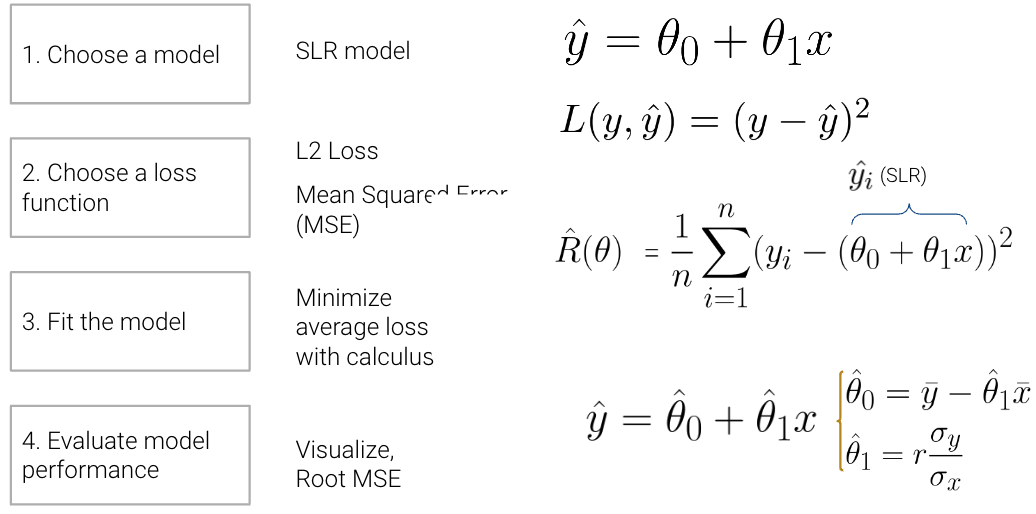

from mpl_toolkits.mplot3d import Axes3DLast time, we introduced the modeling process. We set up a framework to predict target variables as functions of our features, following a set workflow:

To illustrate this process, we derived the optimal model parameters under simple linear regression (SLR) with mean squared error (MSE) as the cost function. A summary of the SLR modeling process is shown below:

In this lecture, we’ll dive deeper into step 4 - evaluating model performance - using SLR as an example. Additionally, we’ll also explore the modeling process with new models, continue familiarizing ourselves with the modeling process by finding the best model parameters under a new model, the constant model, and test out two different loss functions to understand how our choice of loss influences model design. Later on, we’ll consider what happens when a linear model isn’t the best choice to capture trends in our data and what solutions there are to create better models.

Now that we’ve explored the mathematics behind (1) choosing a model, (2) choosing a loss function, and (3) fitting the model, we’re left with one final question – how “good” are the predictions made by this “best” fitted model? To determine this, we can:

Visualize data and compute statistics:

Performance metrics:

\[\text{RMSE} = \sqrt{\frac{1}{n} \sum_{i=1}^n (y_i - \hat{y}_i)^2}\]

Visualization:

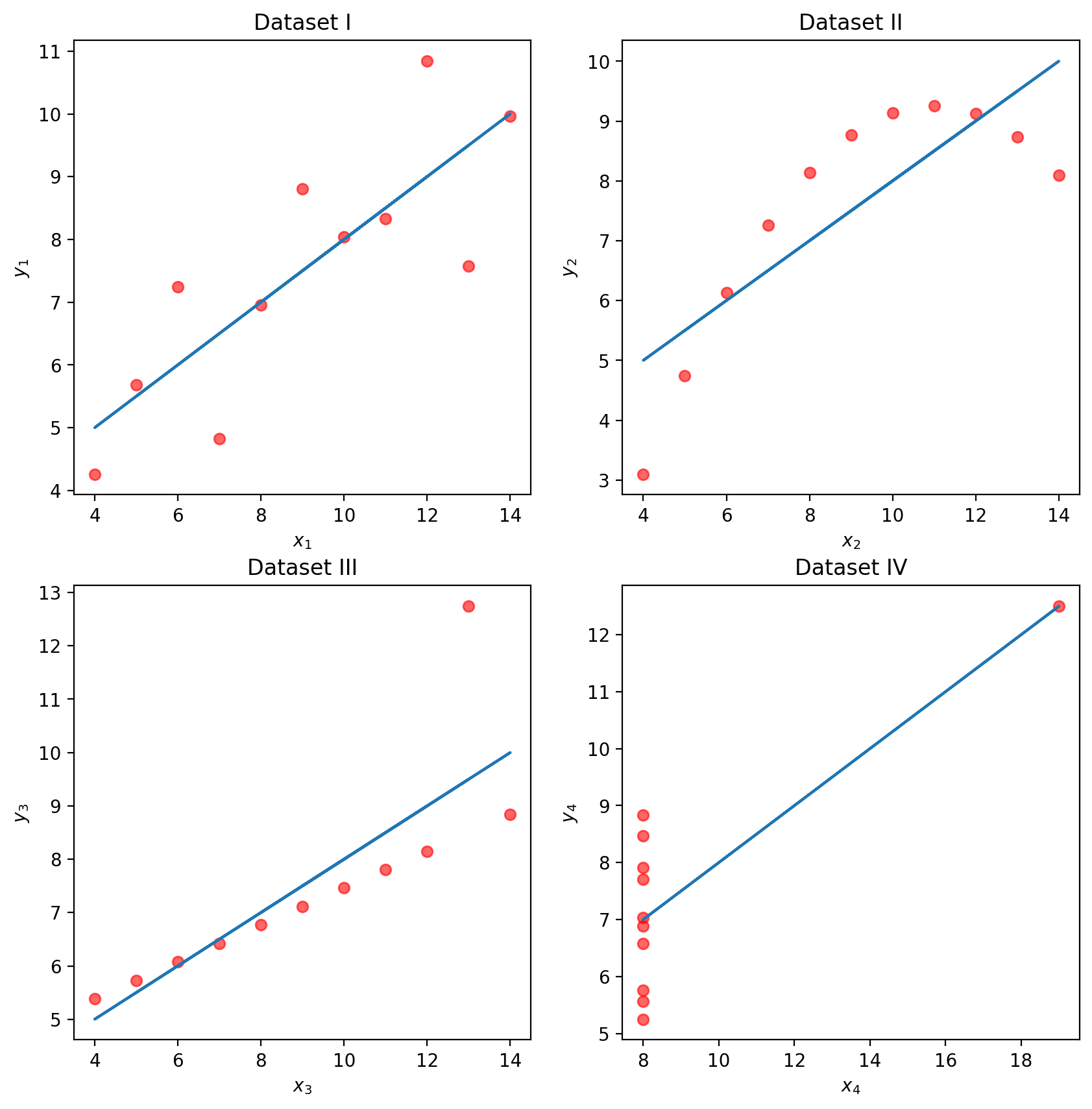

To illustrate this process, let’s take a look at Anscombe’s quartet.

Let’s take a look at four different datasets.

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

%matplotlib inline

import seaborn as sns

import itertools

from mpl_toolkits.mplot3d import Axes3D# Big font helper

def adjust_fontsize(size=None):

SMALL_SIZE = 8

MEDIUM_SIZE = 10

BIGGER_SIZE = 12

if size != None:

SMALL_SIZE = MEDIUM_SIZE = BIGGER_SIZE = size

plt.rc('font', size=SMALL_SIZE) # controls default text sizes

plt.rc('axes', titlesize=SMALL_SIZE) # fontsize of the axes title

plt.rc('axes', labelsize=MEDIUM_SIZE) # fontsize of the x and y labels

plt.rc('xtick', labelsize=SMALL_SIZE) # fontsize of the tick labels

plt.rc('ytick', labelsize=SMALL_SIZE) # fontsize of the tick labels

plt.rc('legend', fontsize=SMALL_SIZE) # legend fontsize

plt.rc('figure', titlesize=BIGGER_SIZE) # fontsize of the figure title

# Helper functions

def standard_units(x):

return (x - np.mean(x)) / np.std(x)

def correlation(x, y):

return np.mean(standard_units(x) * standard_units(y))

def slope(x, y):

return correlation(x, y) * np.std(y) / np.std(x)

def intercept(x, y):

return np.mean(y) - slope(x, y)*np.mean(x)

def fit_least_squares(x, y):

theta_0 = intercept(x, y)

theta_1 = slope(x, y)

return theta_0, theta_1

def predict(x, theta_0, theta_1):

return theta_0 + theta_1*x

def compute_mse(y, yhat):

return np.mean((y - yhat)**2)

plt.style.use('default') # Revert style to default mplplt.style.use('default') # Revert style to default mpl

NO_VIZ, RESID, RESID_SCATTER = range(3)

def least_squares_evaluation(x, y, visualize=NO_VIZ):

# statistics

print(f"x_mean : {np.mean(x):.2f}, y_mean : {np.mean(y):.2f}")

print(f"x_stdev: {np.std(x):.2f}, y_stdev: {np.std(y):.2f}")

print(f"r = Correlation(x, y): {correlation(x, y):.3f}")

# Performance metrics

ahat, bhat = fit_least_squares(x, y)

yhat = predict(x, ahat, bhat)

print(f"\theta_0: {ahat:.2f}, \theta_1: {bhat:.2f}")

print(f"RMSE: {np.sqrt(compute_mse(y, yhat)):.3f}")

# visualization

fig, ax_resid = None, None

if visualize == RESID_SCATTER:

fig, axs = plt.subplots(1,2,figsize=(8, 3))

axs[0].scatter(x, y)

axs[0].plot(x, yhat)

axs[0].set_title("LS fit")

ax_resid = axs[1]

elif visualize == RESID:

fig = plt.figure(figsize=(4, 3))

ax_resid = plt.gca()

if ax_resid is not None:

ax_resid.scatter(x, y - yhat, color = 'red')

ax_resid.plot([4, 14], [0, 0], color = 'black')

ax_resid.set_title("Residuals")

return fig# Load in four different datasets: I, II, III, IV

x = [10, 8, 13, 9, 11, 14, 6, 4, 12, 7, 5]

y1 = [8.04, 6.95, 7.58, 8.81, 8.33, 9.96, 7.24, 4.26, 10.84, 4.82, 5.68]

y2 = [9.14, 8.14, 8.74, 8.77, 9.26, 8.10, 6.13, 3.10, 9.13, 7.26, 4.74]

y3 = [7.46, 6.77, 12.74, 7.11, 7.81, 8.84, 6.08, 5.39, 8.15, 6.42, 5.73]

x4 = [8, 8, 8, 8, 8, 8, 8, 19, 8, 8, 8]

y4 = [6.58, 5.76, 7.71, 8.84, 8.47, 7.04, 5.25, 12.50, 5.56, 7.91, 6.89]

anscombe = {

'I': pd.DataFrame(list(zip(x, y1)), columns =['x', 'y']),

'II': pd.DataFrame(list(zip(x, y2)), columns =['x', 'y']),

'III': pd.DataFrame(list(zip(x, y3)), columns =['x', 'y']),

'IV': pd.DataFrame(list(zip(x4, y4)), columns =['x', 'y'])

}

# Plot the scatter plot and line of best fit

fig, axs = plt.subplots(2, 2, figsize = (10, 10))

for i, dataset in enumerate(['I', 'II', 'III', 'IV']):

ans = anscombe[dataset]

x, y = ans['x'], ans['y']

ahat, bhat = fit_least_squares(x, y)

yhat = predict(x, ahat, bhat)

axs[i//2, i%2].scatter(x, y, alpha=0.6, color='red') # plot the x, y points

axs[i//2, i%2].plot(x, yhat) # plot the line of best fit

axs[i//2, i%2].set_xlabel(f'$x_{i+1}$')

axs[i//2, i%2].set_ylabel(f'$y_{i+1}$')

axs[i//2, i%2].set_title(f"Dataset {dataset}")

plt.show()

While these four sets of datapoints look very different, they actually all have identical \(\bar x\), \(\bar y\), \(\sigma_x\), \(\sigma_y\), correlation \(r\), and RMSE! If we only look at these statistics, we would probably be inclined to say that these datasets are similar.

for dataset in ['I', 'II', 'III', 'IV']:

print(f">>> Dataset {dataset}:")

ans = anscombe[dataset]

fig = least_squares_evaluation(ans['x'], ans['y'], visualize = NO_VIZ)

print()

print()>>> Dataset I:

x_mean : 9.00, y_mean : 7.50

x_stdev: 3.16, y_stdev: 1.94

r = Correlation(x, y): 0.816

heta_0: 3.00, heta_1: 0.50

RMSE: 1.119

>>> Dataset II:

x_mean : 9.00, y_mean : 7.50

x_stdev: 3.16, y_stdev: 1.94

r = Correlation(x, y): 0.816

heta_0: 3.00, heta_1: 0.50

RMSE: 1.119

>>> Dataset III:

x_mean : 9.00, y_mean : 7.50

x_stdev: 3.16, y_stdev: 1.94

r = Correlation(x, y): 0.816

heta_0: 3.00, heta_1: 0.50

RMSE: 1.118

>>> Dataset IV:

x_mean : 9.00, y_mean : 7.50

x_stdev: 3.16, y_stdev: 1.94

r = Correlation(x, y): 0.817

heta_0: 3.00, heta_1: 0.50

RMSE: 1.118

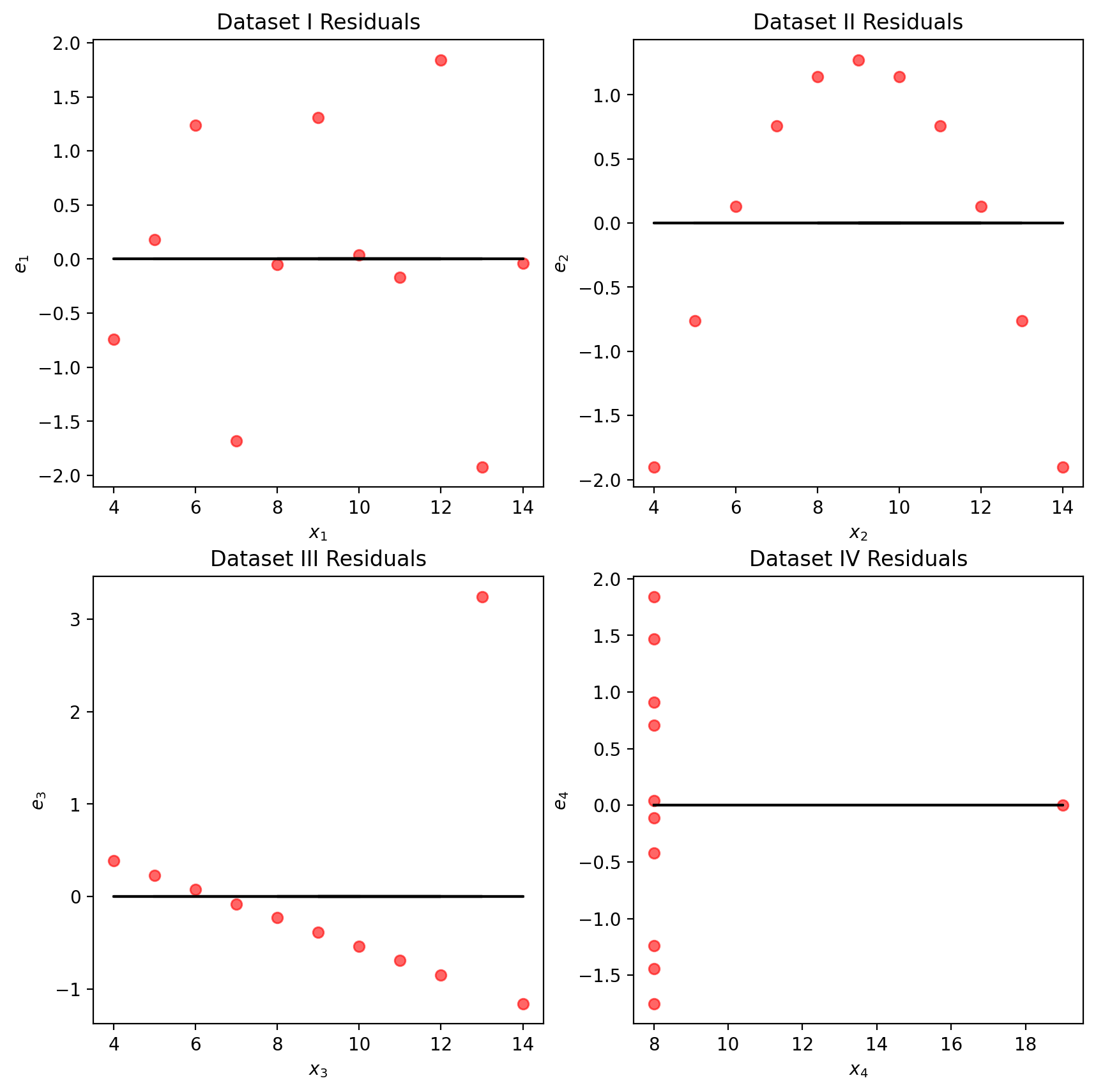

We may also wish to visualize the model’s residuals, defined as the difference between the observed and predicted \(y_i\) value (\(e_i = y_i - \hat{y}_i\)). This gives a high-level view of how “off” each prediction is from the true observed value. Recall that you explored this concept in Data 8: a good regression fit should display no clear pattern in its plot of residuals. The residual plots for Anscombe’s quartet are displayed below. Note how only the first plot shows no clear pattern to the magnitude of residuals. This is an indication that SLR is not the best choice of model for the remaining three sets of points.

# Residual visualization

fig, axs = plt.subplots(2, 2, figsize = (10, 10))

for i, dataset in enumerate(['I', 'II', 'III', 'IV']):

ans = anscombe[dataset]

x, y = ans['x'], ans['y']

ahat, bhat = fit_least_squares(x, y)

yhat = predict(x, ahat, bhat)

axs[i//2, i%2].scatter(x, y - yhat, alpha=0.6, color='red') # plot the x, y points

axs[i//2, i%2].plot(x, np.zeros_like(x), color='black') # plot the residual line

axs[i//2, i%2].set_xlabel(f'$x_{i+1}$')

axs[i//2, i%2].set_ylabel(f'$e_{i+1}$')

axs[i//2, i%2].set_title(f"Dataset {dataset} Residuals")

plt.show()

The terms prediction and estimation are often used somewhat interchangeably, but there is a subtle difference between them. Estimation is the task of using data to calculate model parameters. Prediction is the task of using a model to predict outputs for unseen data. In our simple linear regression model

\[\hat{y} = \hat{\theta_0} + \hat{\theta_1}\]

we estimate the parameters by minimizing average loss; then, we predict using these estimations. Least Squares Estimation is when we choose the parameters that minimize MSE.

Now, we’ll shift from the SLR model to the constant model, also known as a summary statistic. The constant model is slightly different from the simple linear regression model we’ve explored previously. Rather than generating predictions from an inputted feature variable, the constant model always predicts the same constant number. This ignores any relationships between variables. For example, let’s say we want to predict the number of drinks a boba shop sells in a day. Boba tea sales likely depend on the time of year, the weather, how the customers feel, whether school is in session, etc., but the constant model ignores these factors in favor of a simpler model. In other words, the constant model employs a simplifying assumption.

It is also a parametric, statistical model:

\[\hat{y}_i = \theta_0\]

\(\theta_0\) is the parameter of the constant model, just as \(\theta_0\) and \(\theta_1\) were the parameters in SLR. Since our parameter \(\theta_0\) is 1-dimensional (\(\theta_0 \in \mathbb{R}\)), we now have no input to our model and will always predict \(\hat{y}_i = \theta_0\).

Our task now is to determine what value of \(\theta_0\) best represents the optimal model – in other words, what number should we guess each time to have the lowest possible average loss on our data?

Like before, we’ll use Mean Squared Error (MSE). Recall that the MSE is average squared loss (L2 loss) over the data \(D = \{y_1, y_2, ..., y_n\}\).

\[R(\theta) = \frac{1}{n}\sum^{n}_{i=1} (y_i - \hat{y_i})^2 \]

Our modeling process now looks like this:

Given the constant model \(\hat{y}_i = \theta_0\), we can rewrite the MSE equation as

\[R(\theta) = \frac{1}{n}\sum^{n}_{i=1} (y_i - \theta_0)^2 \]

We can fit the model by finding the optimal \(\theta_0\) that minimizes the MSE using a calculus approach.

\[ \begin{align} \frac{d}{d\theta_0}\text{R}(\theta) & = \frac{d}{d\theta_0}\frac{1}{n}\sum^{n}_{i=1} (y_i - \theta_0)^2 \\ &= {n}\sum^{n}_{i=1} \frac{d}{d\theta_0} (y_i - \theta_0)^2 \quad \quad \text{derivative of sum is a sum of derivatives} \\ &= {n}\sum^{n}_{i=1} 2 (y_i - \theta_0) (-1) \quad \quad \text{chain rule} \\ &= {\frac{-2}{n}}\sum^{n}_{i=1} (y_i - \theta_0) \quad \quad \text{simply constants} \end{align} \]

Set equal to 0 \[ 0 = {\frac{-2}{n}}\sum^{n}_{i=1} (y_i - \theta_0) \]

Solve for \(\theta_0\)

\[ \begin{align} 0 &= {\frac{-2}{n}}\sum^{n}_{i=1} (y_i - \theta_0) \\ &= \sum^{n}_{i=1} (y_i - \theta_0) \quad \quad \text{divide both sides by} \frac{-2}{n} \\ &= \sum^{n}_{i=1} y_i - \sum^{n}_{i=1} \theta_0 \quad \quad \text{separate sums} \\ &= \sum^{n}_{i=1} y_i - n * \theta_0 \quad \quad \text{c + c + … + c = nc} \\ n * \theta_0 &= \sum^{n}_{i=1} y_i \\ \theta_0 &= \frac{1}{n} \sum^{n}_{i=1} y_i \\ \theta_0 &= \bar{y} \end{align} \]

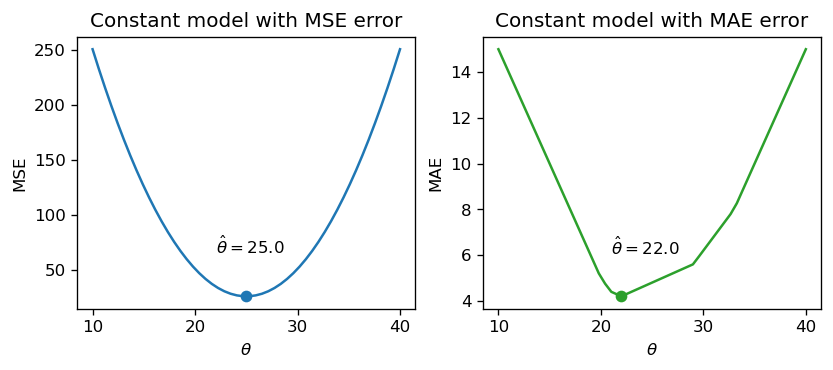

Let’s take a moment to interpret this result. \(\hat{\theta} = \bar{y}\) is the optimal parameter for constant model + MSE. It holds true regardless of what data sample you have, and it provides some formal reasoning as to why the mean is such a common summary statistic.

Our optimal model parameter is the value of the parameter that minimizes the cost function. This minimum value of the cost function can be expressed:

\[R(\hat{\theta}) = \min_{\theta} R(\theta)\]

To restate the above in plain English: we are looking at the value of the cost function when it takes the best parameter as input. This optimal model parameter, \(\hat{\theta}\), is the value of \(\theta\) that minimizes the cost \(R\).

For modeling purposes, we care less about the minimum value of cost, \(R(\hat{\theta})\), and more about the value of \(\theta\) that results in this lowest average loss. In other words, we concern ourselves with finding the best parameter value such that:

\[\hat{\theta} = \underset{\theta}{\operatorname{\arg\min}}\:R(\theta)\]

That is, we want to find the argument \(\theta\) that minimizes the cost function.

Now that we’ve explored the constant model with an L2 loss, we can compare it to the SLR model that we learned last lecture. Consider the dataset below, which contains information about the ages and lengths of dugongs. Supposed we wanted to predict dugong ages:

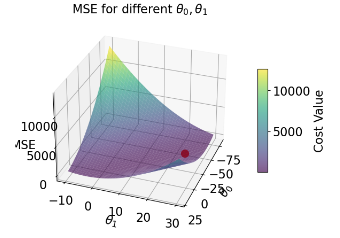

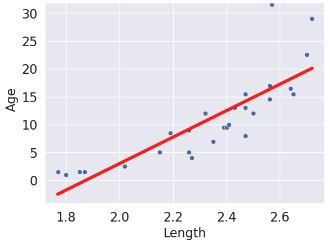

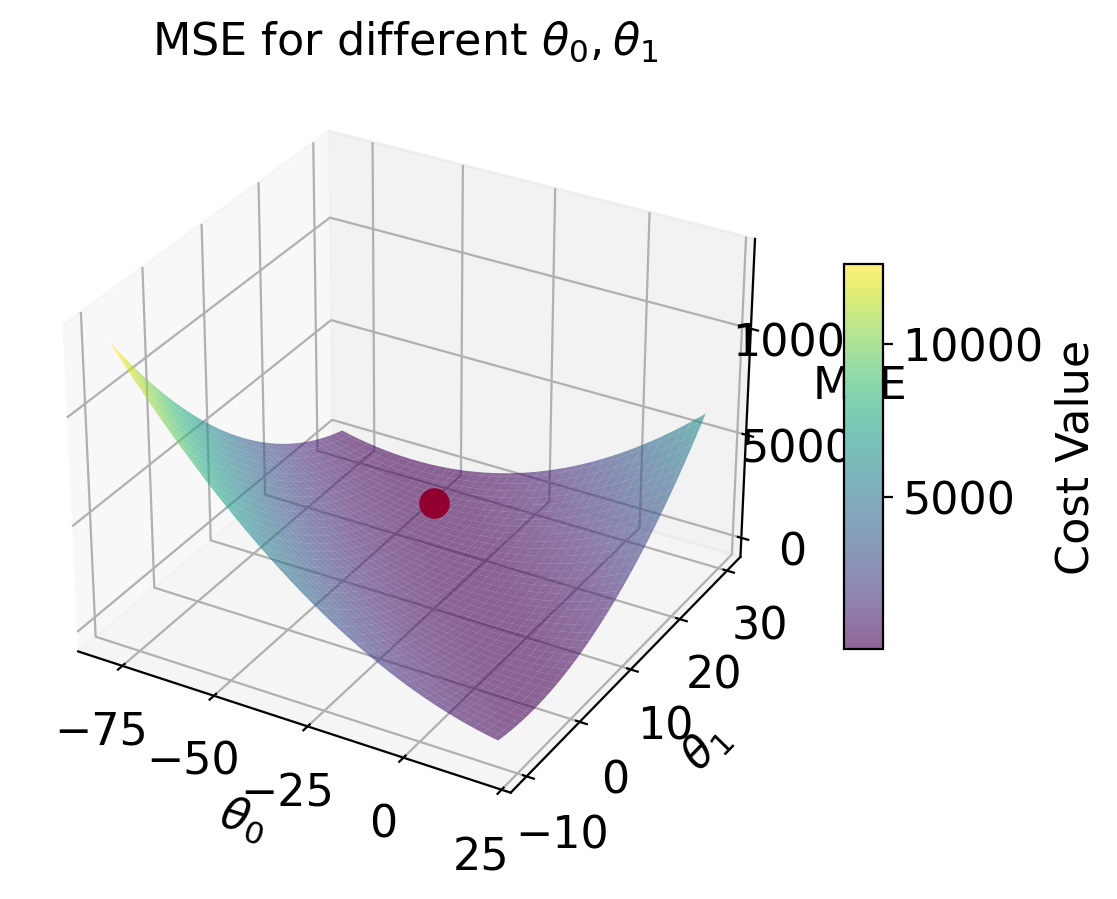

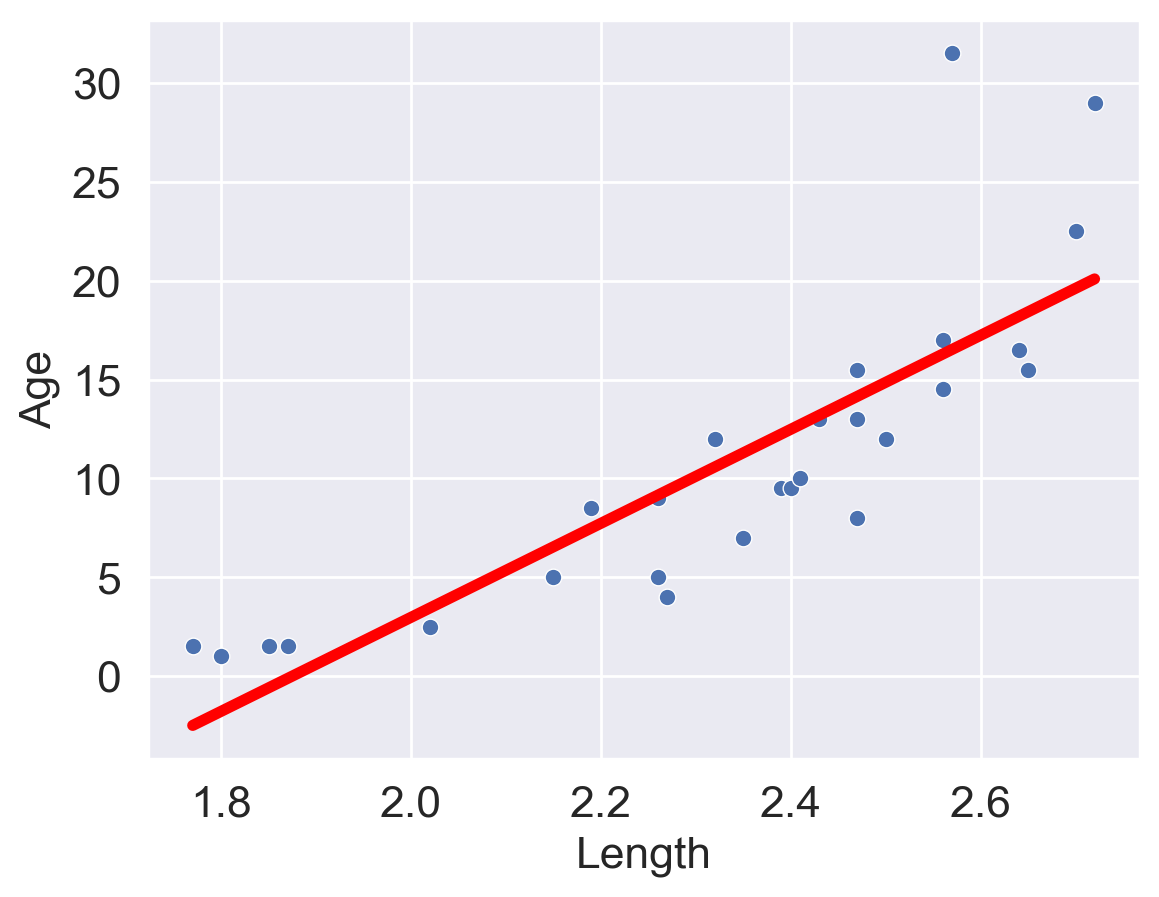

| Constant Model | Simple Linear Regression | |

|---|---|---|

| model | \(\hat{y} = \theta_0\) | \(\hat{y} = \theta_0 + \theta1 x\) |

| data | sample of ages \(D = \{y_1, y_2, ..., y_m\}\) | sample of ages \(D = \{(x_1, y_1), (x_2, y_2), ..., (x_n, y_n)\}\) |

| dimensions | \(\hat{\theta_0}\) is 1-D | \(\hat{\theta} = [\hat{\theta_0}, \hat{\theta_1}]\) is 2-D |

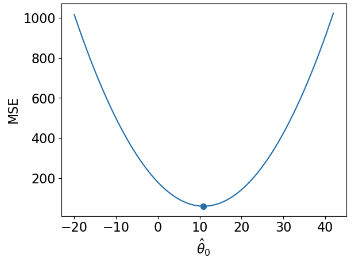

| loss surface | 2-D  |

3-D  |

| Loss Model | \(\hat{R}(\theta) = \frac{1}{n}\sum^{n}_{i=1} (y_i - \theta_0)^2\) | \(\hat{R}(\theta) = \frac{1}{n}\sum^{n}_{i=1} (y_i - (\theta_0 + \theta_1 x))^2\) |

| RMSE | 7.72 | 4.31 |

| predictions visualized | rug plot  |

scatter plot  |

(Notice how the points for our SLR scatter plot are visually not a great linear fit. We’ll come back to this).

The code for generating the graphs and models is included below, but we won’t go over it in too much depth.

dugongs = pd.read_csv("data/dugongs.csv")

data_constant = dugongs["Age"]

data_linear = dugongs[["Length", "Age"]]# Constant Model + MSE

plt.style.use('default') # Revert style to default mpl

adjust_fontsize(size=16)

%matplotlib inline

def mse_constant(theta, data):

return np.mean(np.array([(y_obs - theta) ** 2 for y_obs in data]), axis=0)

thetas = np.linspace(-20, 42, 1000)

l2_loss_thetas = mse_constant(thetas, data_constant)

# Plotting the loss surface

plt.plot(thetas, l2_loss_thetas)

plt.xlabel(r'$\theta_0$')

plt.ylabel(r'MSE')

# Optimal point

thetahat = np.mean(data_constant)

plt.scatter([thetahat], [mse_constant(thetahat, data_constant)], s=50, label = r"$\hat{\theta}_0$")

plt.legend();

# plt.show()

# SLR + MSE

def mse_linear(theta_0, theta_1, data_linear):

data_x, data_y = data_linear.iloc[:,0], data_linear.iloc[:,1]

return np.mean(np.array([(y - (theta_0+theta_1*x)) ** 2 for x, y in zip(data_x, data_y)]), axis=0)

# plotting the loss surface

theta_0_values = np.linspace(-80, 20, 80)

theta_1_values = np.linspace(-10, 30, 80)

mse_values = np.array([[mse_linear(x,y,data_linear) for x in theta_0_values] for y in theta_1_values])

# Optimal point

data_x, data_y = data_linear.iloc[:, 0], data_linear.iloc[:, 1]

theta_1_hat = np.corrcoef(data_x, data_y)[0, 1] * np.std(data_y) / np.std(data_x)

theta_0_hat = np.mean(data_y) - theta_1_hat * np.mean(data_x)

# Create the 3D plot

fig = plt.figure(figsize=(7, 5))

ax = fig.add_subplot(111, projection='3d')

X, Y = np.meshgrid(theta_0_values, theta_1_values)

surf = ax.plot_surface(X, Y, mse_values, cmap='viridis', alpha=0.6) # Use alpha to make it slightly transparent

# Scatter point using matplotlib

sc = ax.scatter([theta_0_hat], [theta_1_hat], [mse_linear(theta_0_hat, theta_1_hat, data_linear)],

marker='o', color='red', s=100, label='theta hat')

# Create a colorbar

cbar = fig.colorbar(surf, ax=ax, shrink=0.5, aspect=10)

cbar.set_label('Cost Value')

ax.set_title('MSE for different $\\theta_0, \\theta_1$')

ax.set_xlabel('$\\theta_0$')

ax.set_ylabel('$\\theta_1$')

ax.set_zlabel('MSE')

# plt.show()Text(0.5, 0, 'MSE')

# Predictions

yobs = data_linear["Age"] # The true observations y

xs = data_linear["Length"] # Needed for linear predictions

n = len(yobs) # Predictions

yhats_constant = [thetahat for i in range(n)] # Not used, but food for thought

yhats_linear = [theta_0_hat + theta_1_hat * x for x in xs]# Constant Model Rug Plot

# In case we're in a weird style state

sns.set_theme()

adjust_fontsize(size=16)

%matplotlib inline

fig = plt.figure(figsize=(8, 1.5))

sns.rugplot(yobs, height=0.25, lw=2) ;

plt.axvline(thetahat, color='red', lw=4, label=r"$\hat{\theta}_0$");

plt.legend()

plt.yticks([]);

# plt.show()

# SLR model scatter plot

# In case we're in a weird style state

sns.set_theme()

adjust_fontsize(size=16)

%matplotlib inline

sns.scatterplot(x=xs, y=yobs)

plt.plot(xs, yhats_linear, color='red', lw=4);

# plt.savefig('dugong_line.png', bbox_inches = 'tight');

# plt.show()

Interpreting the RMSE (Root Mean Squared Error): * The constant error is HIGHER than the linear error.

Hence, * The constant model is WORSE than the linear model (at least for this metric).

We see now that changing the model used for prediction leads to a wildly different result for the optimal model parameter. What happens if we instead change the loss function used in model evaluation?

This time, we will consider the constant model with L1 (absolute loss) as the loss function. This means that the average loss will be expressed as the Mean Absolute Error (MAE).

Recall that the MAE is average absolute loss (L1 loss) over the data \(D = \{y_1, y_2, ..., y_m\}\).

\[\hat{R}(\theta) = \frac{1}{n}\sum^{n}_{i=1} |y_i - \hat{y_i}| \]

Given the constant model \(\hat{y} = \theta_0\), we can write the MAE as:

\[\hat{R}(\theta) = \frac{1}{n}\sum^{n}_{i=1} |y_i - \theta_0| \]

To fit the model, we find the optimal parameter value \(\hat{\theta}\) by differentiating using a calculus approach:

\[\hat{R}(\theta) = \frac{1}{n}\sum^{n}_{i=1} |y_i - \theta| \]

\[\frac{d}{d\theta} R(\theta) = \frac{d}{d\theta} \left(\frac{1}{n} \sum^{n}_{i=1} |y_i - \theta| \right)\]

\[= \frac{1}{n} \sum^{n}_{i=1} \frac{d}{d\theta} |y_i - \theta| \]

\[|y_i - \theta| = \begin{cases} y_i - \theta \quad \text{ if } \theta \le y_i \\ \theta - y_i \quad \text{if }\theta > y_i \end{cases}\]

\[\frac{d}{d\theta} |y_i - \theta| = \begin{cases} \frac{d}{d\theta} (y_i - \theta) = -1 \quad \text{if }\theta < y_i \\ \frac{d}{d\theta} (\theta - y_i) = 1 \quad \text{if }\theta > y_i \end{cases}\]

\[\frac{d}{d\theta} R(\theta) = \frac{1}{n} \sum^{n}_{i=1} \frac{d}{d\theta} |y_i - \theta| \\ = \frac{1}{n} \left[\sum_{\hat{\theta_0} < y_i} (-1) + \sum_{\hat{\theta_0} > y_i} (+1) \right] \]

Set equal to 0. \[ 0 = \frac{1}{n}\sum_{\hat{\theta_0} < y_i} (-1) + \frac{1}{n}\sum_{\hat{\theta_0} > y_i} (+1) \]

Solve for \(\hat{\theta_0}\). \[ 0 = -\frac{1}{n}\sum_{\hat{\theta_0} < y_i} (1) + \frac{1}{n}\sum_{\hat{\theta_0} > y_i} (1)\]

\[\sum_{\hat{\theta_0} < y_i} (1) = \sum_{\hat{\theta_0} > y_i} (1) \]

Thus, the constant model parameter \(\theta = \hat{\theta_0}\) that minimizes MAE must satisfy:

\[ \sum_{\hat{\theta_0} < y_i} (1) = \sum_{\hat{\theta_0} > y_i} (1) \]

In other words, the number of observations greater than \(\theta_0\) must be equal to the number of observations less than \(\theta_0\); there must be an equal number of points on the left and right sides of the equation. This is the definition of median, so our optimal value is \[ \hat{\theta_0} = median(y) \]

First, define the objective function as average loss.

Then, find the minimum of the objective function:

Recall critical points from calculus: \(R(\hat{\theta})\) could be a minimum, maximum, or saddle point! * We should technically also perform the second derivative test, i.e., show \(R''(\hat{\theta}) > 0\). * MSE has a property—convexity—that guarantees that \(R(\hat{\theta})\) is a global minimum. * The proof of convexity for MAE is beyond this course.

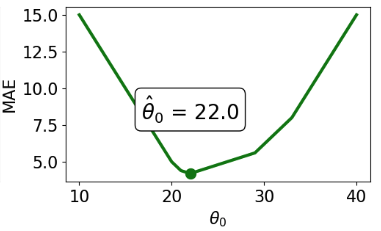

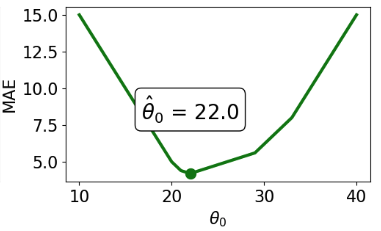

We’ve now tried our hand at fitting a model under both MSE and MAE cost functions. How do the two results compare?

Let’s consider a dataset where each entry represents the number of drinks sold at a bubble tea store each day. We’ll fit a constant model to predict the number of drinks that will be sold tomorrow.

drinks = np.array([20, 21, 22, 29, 33])

drinksarray([20, 21, 22, 29, 33])From our derivations above, we know that the optimal model parameter under MSE cost is the mean of the dataset. Under MAE cost, the optimal parameter is the median of the dataset.

np.mean(drinks), np.median(drinks)(25.0, 22.0)If we plot each empirical risk function across several possible values of \(\theta\), we find that each \(\hat{\theta}\) does indeed correspond to the lowest value of error:

Notice that the MSE above is a smooth function – it is differentiable at all points, making it easy to minimize using numerical methods. The MAE, in contrast, is not differentiable at each of its “kinks.” We’ll explore how the smoothness of the cost function can impact our ability to apply numerical optimization in a few weeks.

How do outliers affect each cost function? Imagine we replace the largest value in the dataset with 1000. The mean of the data increases substantially, while the median is nearly unaffected.

drinks_with_outlier = np.append(drinks, 1033)

display(drinks_with_outlier)

np.mean(drinks_with_outlier), np.median(drinks_with_outlier)array([ 20, 21, 22, 29, 33, 1033])(193.0, 25.5)This means that under the MSE, the optimal model parameter \(\hat{\theta}\) is strongly affected by the presence of outliers. Under the MAE, the optimal parameter is not as influenced by outlying data. We can generalize this by saying that the MSE is sensitive to outliers, while the MAE is robust to outliers.

Let’s try another experiment. This time, we’ll add an additional, non-outlying datapoint to the data.

drinks_with_additional_observation = np.append(drinks, 35)

drinks_with_additional_observationarray([20, 21, 22, 29, 33, 35])When we again visualize the cost functions, we find that the MAE now plots a horizontal line between 22 and 29. This means that there are infinitely many optimal values for the model parameter: any value \(\hat{\theta} \in [22, 29]\) will minimize the MAE. In contrast, the MSE still has a single best value for \(\hat{\theta}\). In other words, the MSE has a unique solution for \(\hat{\theta}\); the MAE is not guaranteed to have a single unique solution.

To summarize our example,

| – | MSE (Mean Squared Loss) | MAE (Mean Absolute Loss) |

|---|---|---|

| Loss Function | \(\hat{R}(\theta) = \frac{1}{n}\sum^{n}_{i=1} (y_i - \theta_0)^2\) | \(\hat{R}(\theta) = \frac{1}{n}\sum^{n}_{i=1} |y_i - \theta_0|\) |

| optimal \(\hat{\theta_0}\) | \(\hat{\theta_0} = mean(y) = \bar{y}\) | \(\hat{\theta_0} = median(y)\) |

| loss surface |  |

|

| shape | Smooth - easy to minimize using numerical methods (in a few weeks) | Piecewise - at each of the “kinks,” it’s not differentiable. Harder to minimize. |

| outliers | Sensitive to outliers (since they change mean substantially). Sensitivity also depends on the dataset size. | More robust to outliers. |

| \(\hat{\theta_0}\) uniqueness | unique \(\hat{\theta_0}\) | Infinitely many \(\hat{\theta_0}\) |

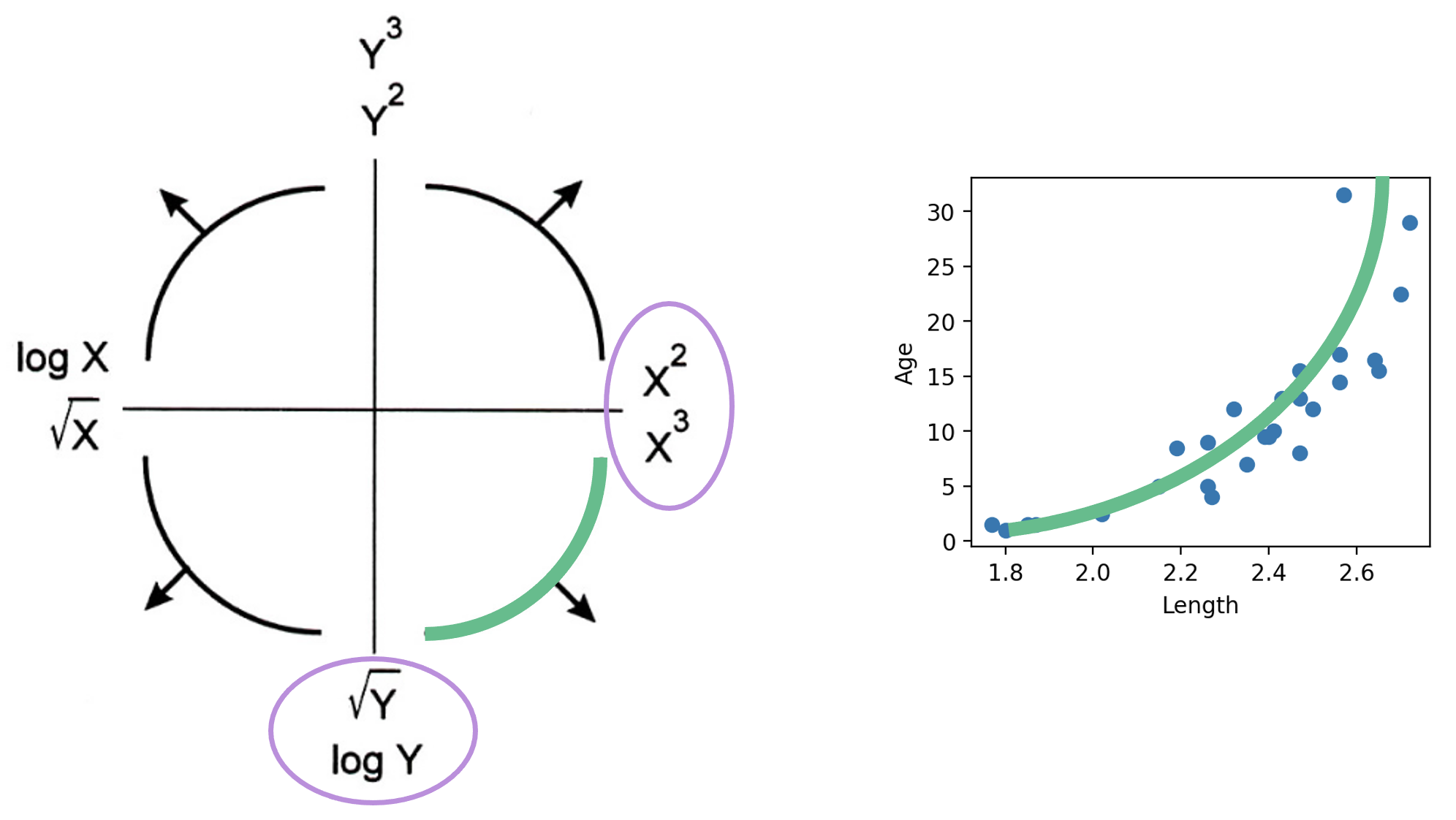

At this point, we have an effective method of fitting models to predict linear relationships. Given a feature variable and target, we can apply our four-step process to find the optimal model parameters.

A key word above is linear. When we computed parameter estimates earlier, we assumed that \(x_i\) and \(y_i\) shared a roughly linear relationship. Data in the real world isn’t always so straightforward, but we can transform the data to try and obtain linearity.

The Tukey-Mosteller Bulge Diagram is a useful tool for summarizing what transformations can linearize the relationship between two variables. To determine what transformations might be appropriate, trace the shape of the “bulge” made by your data. Find the quadrant of the diagram that matches this bulge. The transformations shown on the vertical and horizontal axes of this quadrant can help improve the fit between the variables.

Note that:

Other goals in addition to linearity are possible, for example, making data appear more symmetric. Linearity allows us to fit lines to the transformed data.

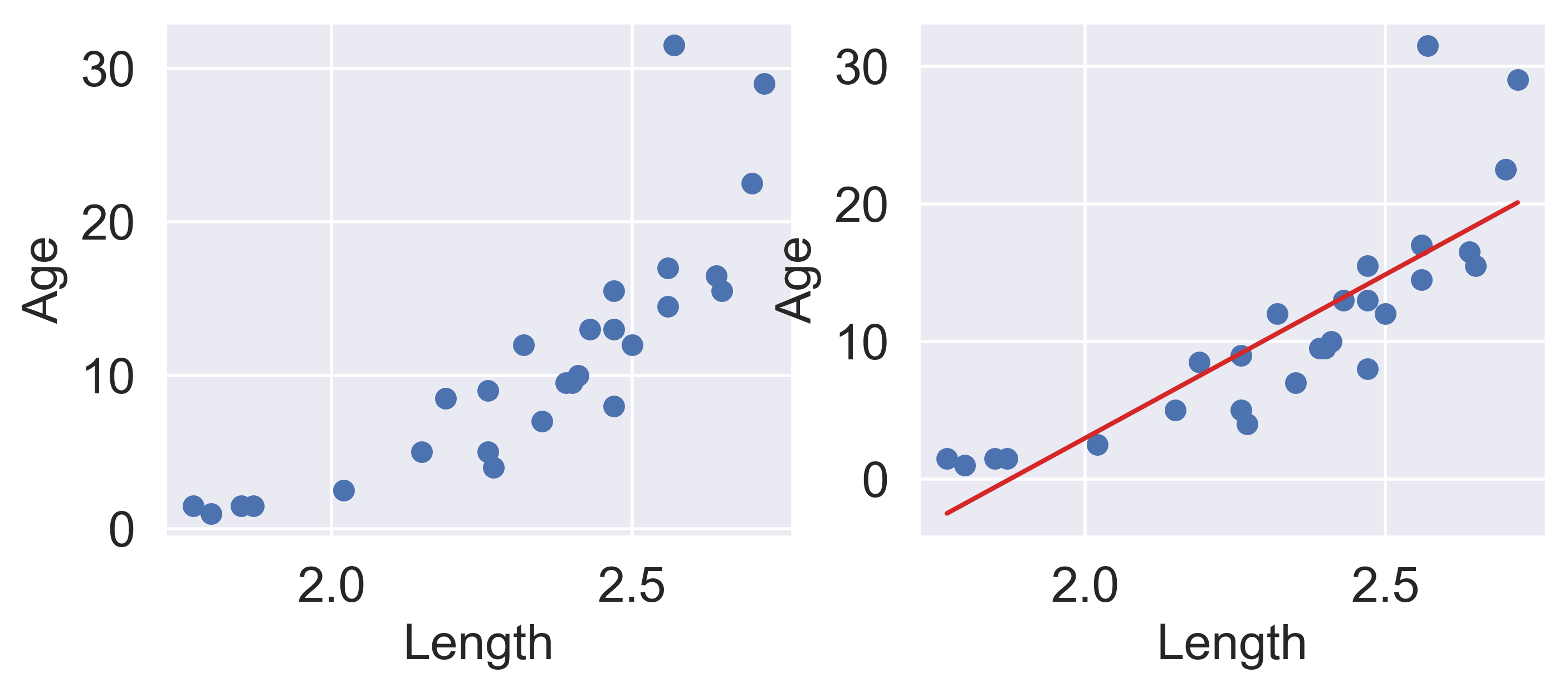

Let’s revisit our dugongs example. The lengths and ages are plotted below:

# `corrcoef` computes the correlation coefficient between two variables

# `std` finds the standard deviation

x = dugongs["Length"]

y = dugongs["Age"]

r = np.corrcoef(x, y)[0, 1]

theta_1 = r*np.std(y)/np.std(x)

theta_0 = np.mean(y) - theta_1*np.mean(x)

fig, ax = plt.subplots(1, 2, dpi=200, figsize=(8, 3))

ax[0].scatter(x, y)

ax[0].set_xlabel("Length")

ax[0].set_ylabel("Age")

ax[1].scatter(x, y)

ax[1].plot(x, theta_0 + theta_1*x, "tab:red")

ax[1].set_xlabel("Length")

ax[1].set_ylabel("Age");

Looking at the plot on the left, we see that there is a slight curvature to the data points. Plotting the SLR curve on the right results in a poor fit.

For SLR to perform well, we’d like there to be a rough linear trend relating "Age" and "Length". What is making the raw data deviate from a linear relationship? Notice that the data points with "Length" greater than 2.6 have disproportionately high values of "Age" relative to the rest of the data. If we could manipulate these data points to have lower "Age" values, we’d “shift” these points downwards and reduce the curvature in the data. Applying a logarithmic transformation to \(y_i\) (that is, taking \(\log(\) "Age" \()\) ) would achieve just that.

An important word on \(\log\): in Data 100 (and most upper-division STEM courses), \(\log\) denotes the natural logarithm with base \(e\). The base-10 logarithm, where relevant, is indicated by \(\log_{10}\).

z = np.log(y)

r = np.corrcoef(x, z)[0, 1]

theta_1 = r*np.std(z)/np.std(x)

theta_0 = np.mean(z) - theta_1*np.mean(x)

fig, ax = plt.subplots(1, 2, dpi=200, figsize=(8, 3))

ax[0].scatter(x, z)

ax[0].set_xlabel("Length")

ax[0].set_ylabel(r"$\log{(Age)}$")

ax[1].scatter(x, z)

ax[1].plot(x, theta_0 + theta_1*x, "tab:red")

ax[1].set_xlabel("Length")

ax[1].set_ylabel(r"$\log{(Age)}$")

plt.subplots_adjust(wspace=0.3);

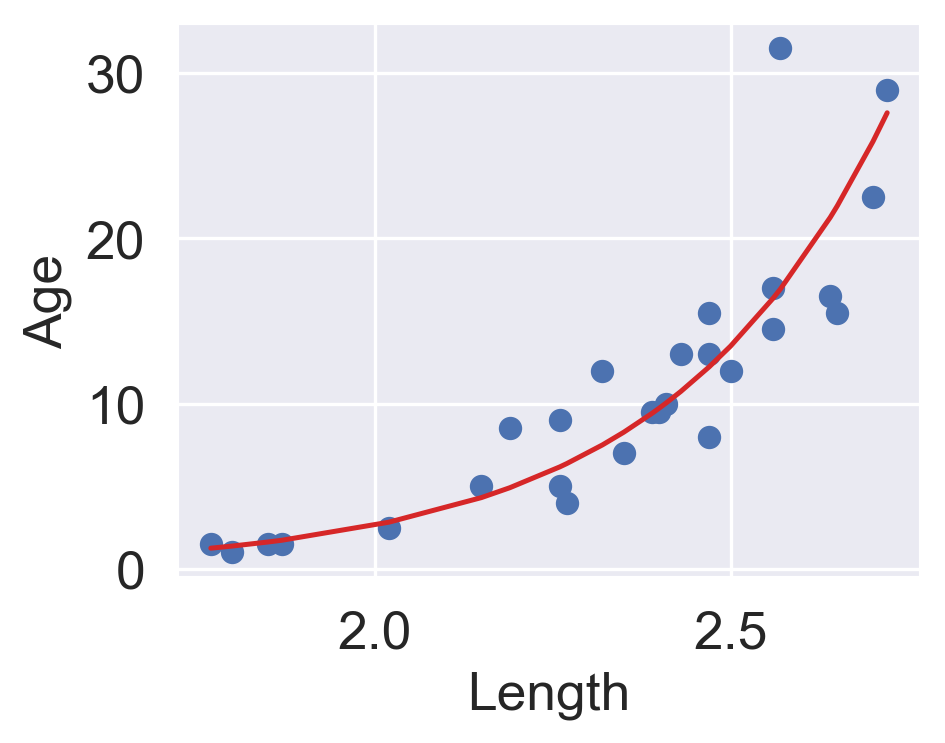

Our SLR fit looks a lot better! We now have a new target variable: the SLR model is now trying to predict the log of "Age", rather than the untransformed "Age". In other words, we are applying the transformation \(z_i = \log{(y_i)}\). Notice that the resulting model is still linear in the parameters \(\theta = [\theta_0, \theta_1]\). The SLR model becomes:

\[\log{\hat{(y_i)}} = \theta_0 + \theta_1 x_i\] \[\hat{z}_i = \theta_0 + \theta_1 x_i\]

It turns out that this linearized relationship can help us understand the underlying relationship between \(x_i\) and \(y_i\). If we rearrange the relationship above, we find: \[ \log{(y_i)} = \theta_0 + \theta_1 x_i \\ y_i = e^{\theta_0 + \theta_1 x_i} \\ y_i = (e^{\theta_0})e^{\theta_1 x_i} \\ y_i = C e^{k x_i} \]

For some constants \(C\) and \(k\).

\(y_i\) is an exponential function of \(x_i\). Applying an exponential fit to the untransformed variables corroborates this finding.

plt.figure(dpi=120, figsize=(4, 3))

plt.scatter(x, y)

plt.plot(x, np.exp(theta_0)*np.exp(theta_1*x), "tab:red")

plt.xlabel("Length")

plt.ylabel("Age");

You may wonder: why did we choose to apply a log transformation specifically? Why not some other function to linearize the data?

Practically, many other mathematical operations that modify the relative scales of "Age" and "Length" could have worked here.